INVESTMENTS

Investing in Dubai can be attractive for several reasons compared to other locations. Here are some factors that have historically made Dubai an appealing investment destination:

Dubai is strategically located at the intersection of Europe, Asia, and Africa. Its proximity to major global markets makes it a favorable hub for trade and commercial activities.

ECONOMIC STABILITY:

The United Arab Emirates, where Dubai is located, has maintained a stable and diversified economy. The government has implemented several policies to attract foreign investments and promote economic growth.

TAX ADVANTAGES:

Dubai offers various tax incentives, including exemptions from personal income tax, corporate tax, and capital gains tax. This favorable tax environment can significantly benefit investors.

SECURITY:

Dubai is known for its safety and low crime rate, making it an attractive destination for businesses and individuals.

BUSINESS-FRIENDLY ENVIRONMENT:

Dubai has simplified processes for starting and managing a business. The government has taken measures to reduce bureaucratic obstacles and facilitate new ventures.

FREE ZONES:

Dubai has several free zones, each designed for specific industries, where companies can benefit from tax exemptions, 100% foreign ownership, and customs duty privileges.

DIVERSIFIED ECONOMY:

Dubai has diversified its economy beyond oil and gas, now boasting a thriving real estate sector, a robust tourism industry, strong financial services, and an expanding technology sector.

REAL ESTATE MARKET OPPORTUNITIES:

Dubai’s real estate market attracts investors from around the world with high rental yields and capital appreciation.

TOURISM:

Dubai is a significant tourist destination, attracting millions of visitors each year. This offers investment opportunities in the hospitality and tourism sectors.

ACCESS TO CAPITAL:

Dubai is home to various international banks and financial institutions, providing easy access to capital for businesses and entrepreneurs.

STRATEGIC LOCATION:

ECONOMIC STABILITY:

Dubai is strategically located at the intersection of Europe, Asia, and Africa. Its proximity to major global markets makes it a favorable hub for trade and commercial activities.

The United Arab Emirates, where Dubai is located, has maintained a stable and diversified economy. The government has implemented several policies to attract foreign investments and promote economic growth.

TAX ADVANTAGES:

SECURITY:

Dubai offers various tax incentives, including exemptions from personal income tax, corporate tax, and capital gains tax. This favorable tax environment can significantly benefit investors.

Dubai is known for its safety and low crime rate, making it an attractive destination for businesses and individuals.

BUSINESS-FRIENDLY ENVIRONMENT:

FREE ZONES:

Dubai has simplified processes for starting and managing a business. The government has taken measures to reduce bureaucratic obstacles and facilitate new ventures.

Dubai has several free zones, each designed for specific industries, where companies can benefit from tax exemptions, 100% foreign ownership, and customs duty privileges.

DIVERSIFIED ECONOMY:

REAL ESTATE MARKET OPPORTUNITIES:

Dubai has diversified its economy beyond oil and gas, now boasting a thriving real estate sector, a robust tourism industry, strong financial services, and an expanding technology sector.

Dubai’s real estate market attracts investors from around the world with high rental yields and capital appreciation.

TOURISM:

ACCESS TO CAPITAL:

Dubai is a significant tourist destination, attracting millions of visitors each year. This offers investment opportunities in the hospitality and tourism sectors.

Dubai is home to various international banks and financial institutions, providing easy access to capital for businesses and entrepreneurs.

Discover the Golden Opportunities in Dubai’s Real Estate Market!

Have you ever considered diversifying your investments in the real estate market? Dubai, the “City of the Future,” offers a unique opportunity for Brazilian investors looking to reap the rewards of a real estate market that is constantly growing and prospering.

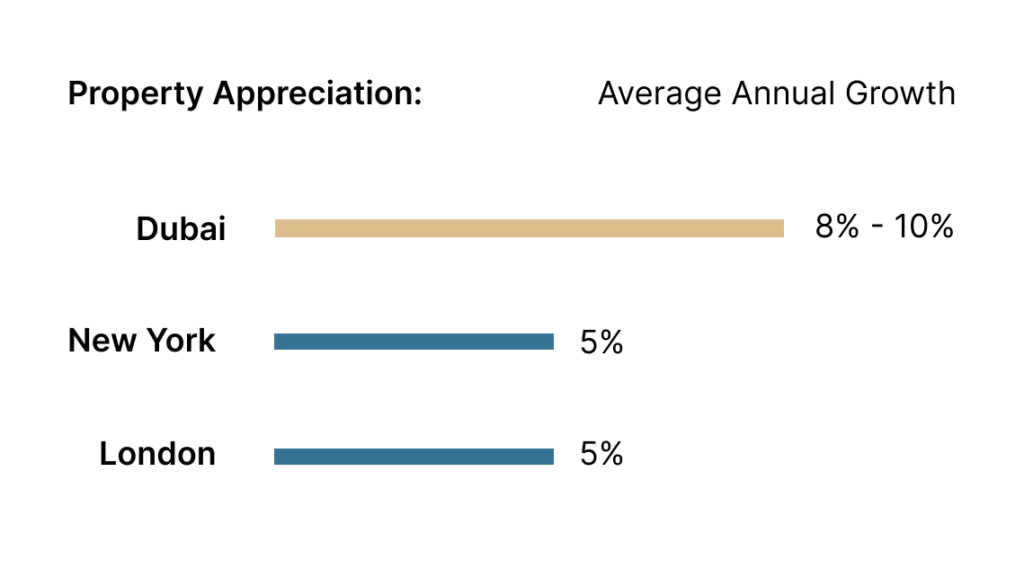

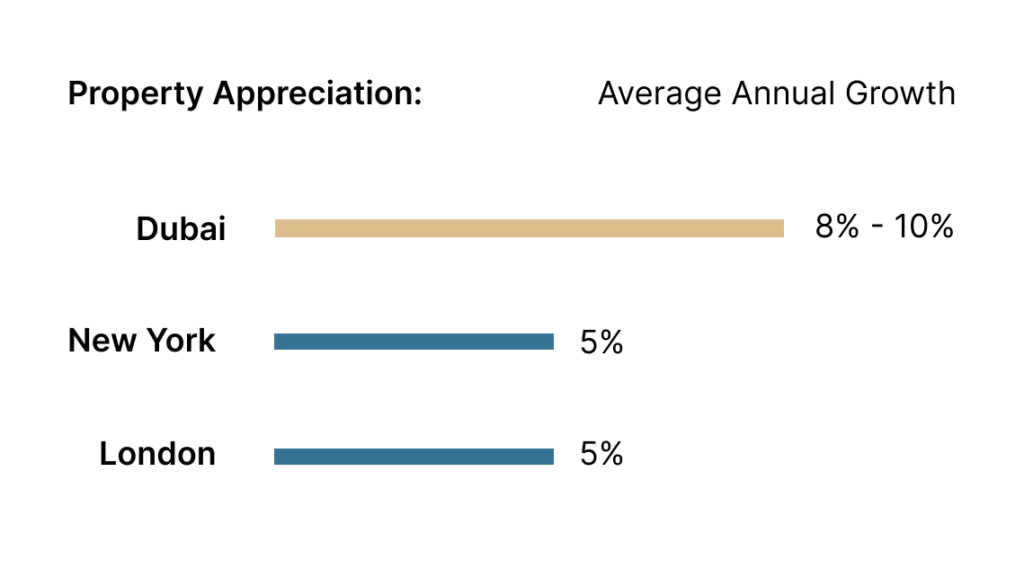

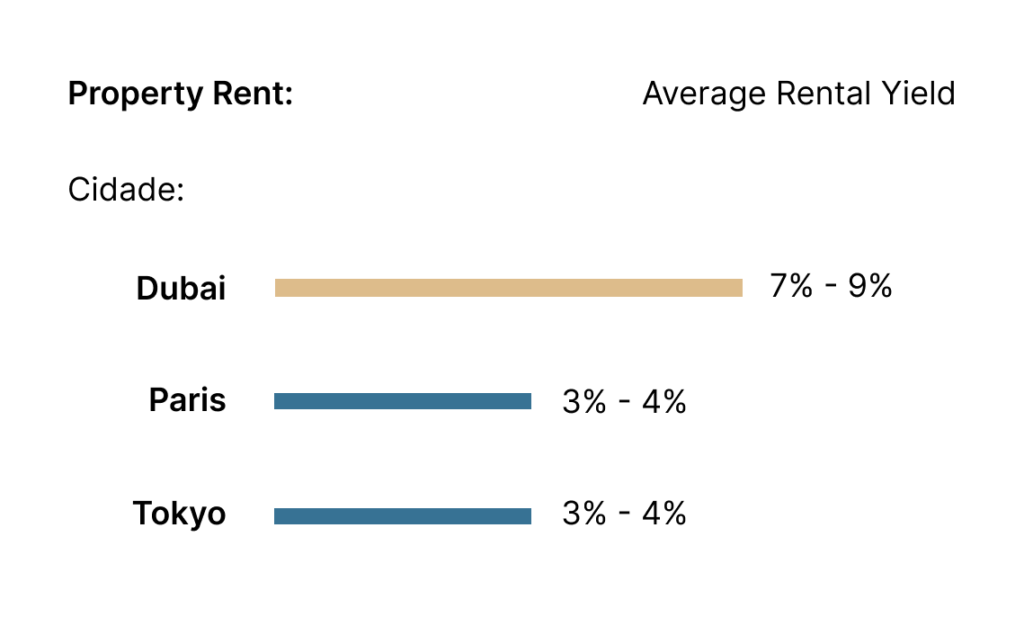

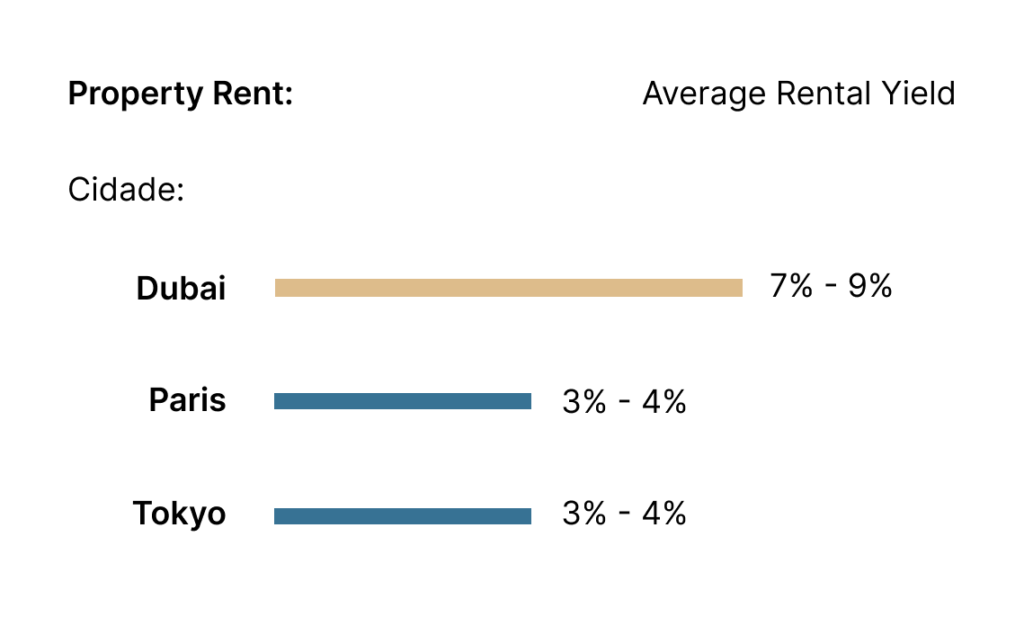

Comparing Dubai to Other Major Cities in the World:

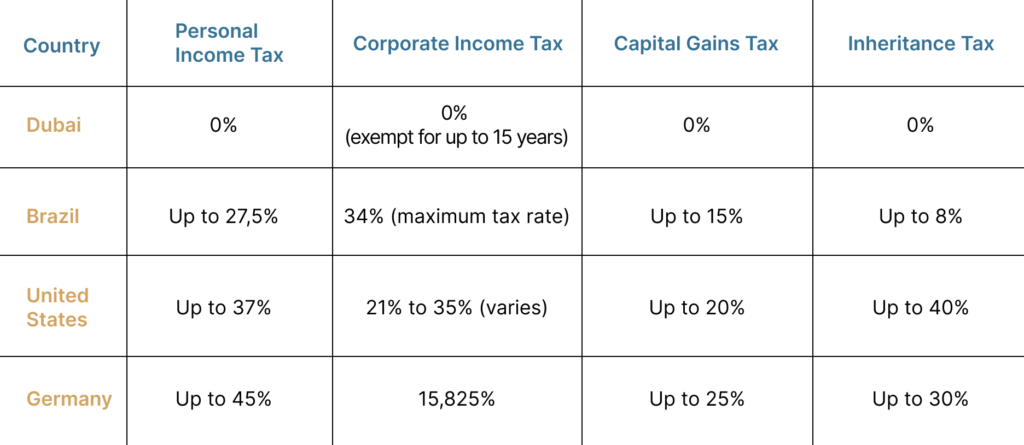

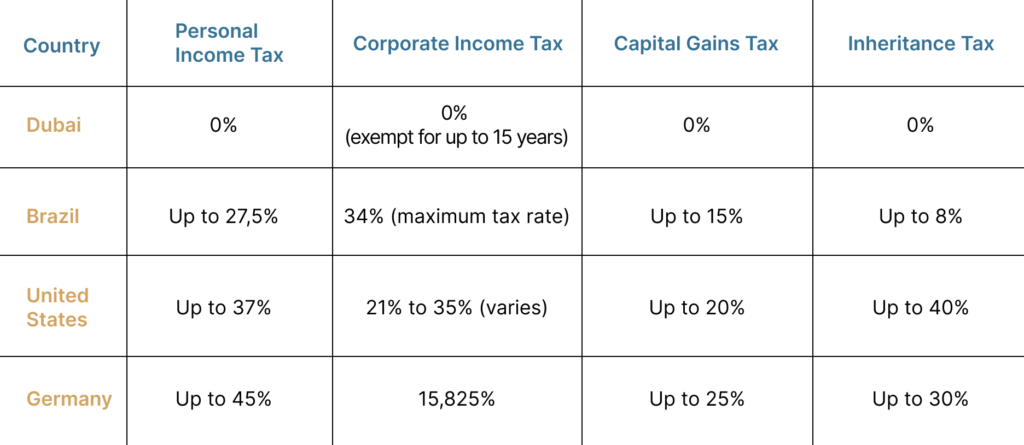

Tax Exemption:

One of the most notable advantages of choosing real estate investments in Dubai is the remarkable exemption from income and capital gains taxes, a feature that substantially distinguishes this jurisdiction when compared to Brazil. This particularity translates into a considerable increase in your profits as an investor.

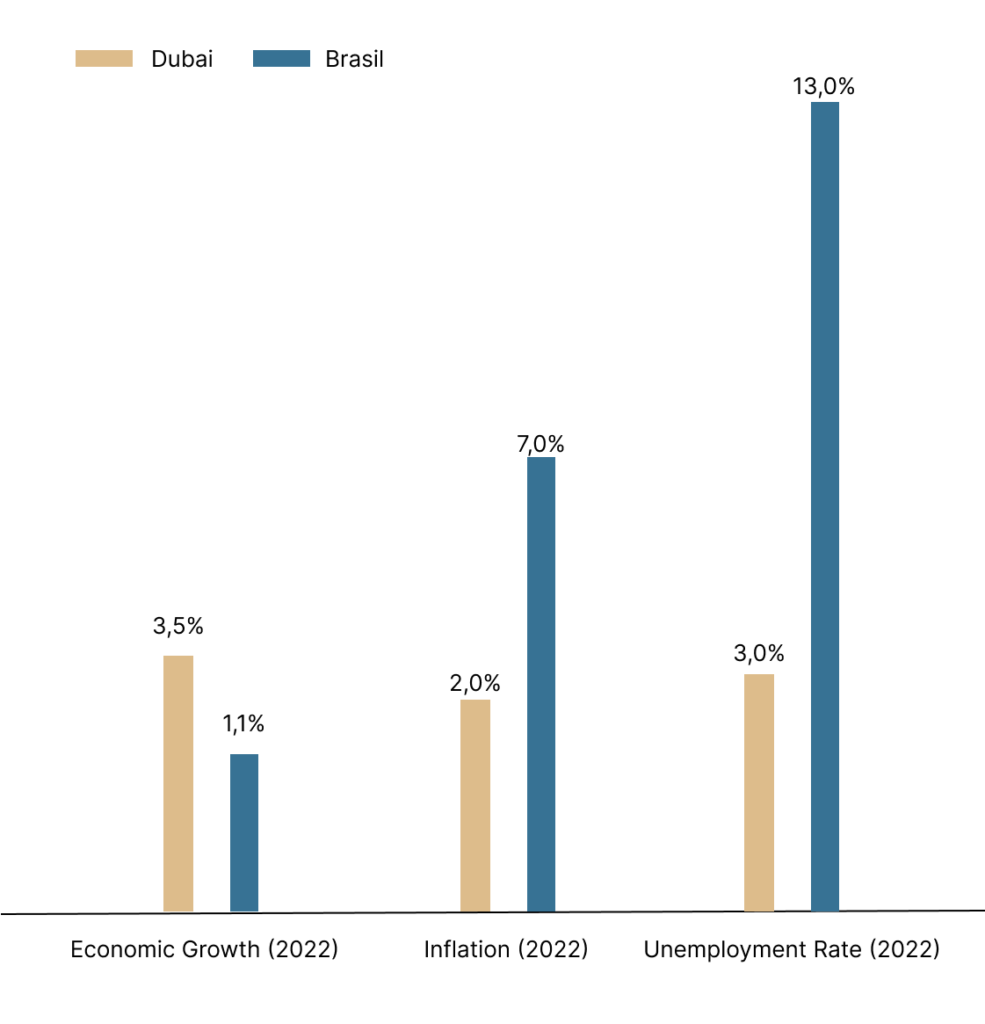

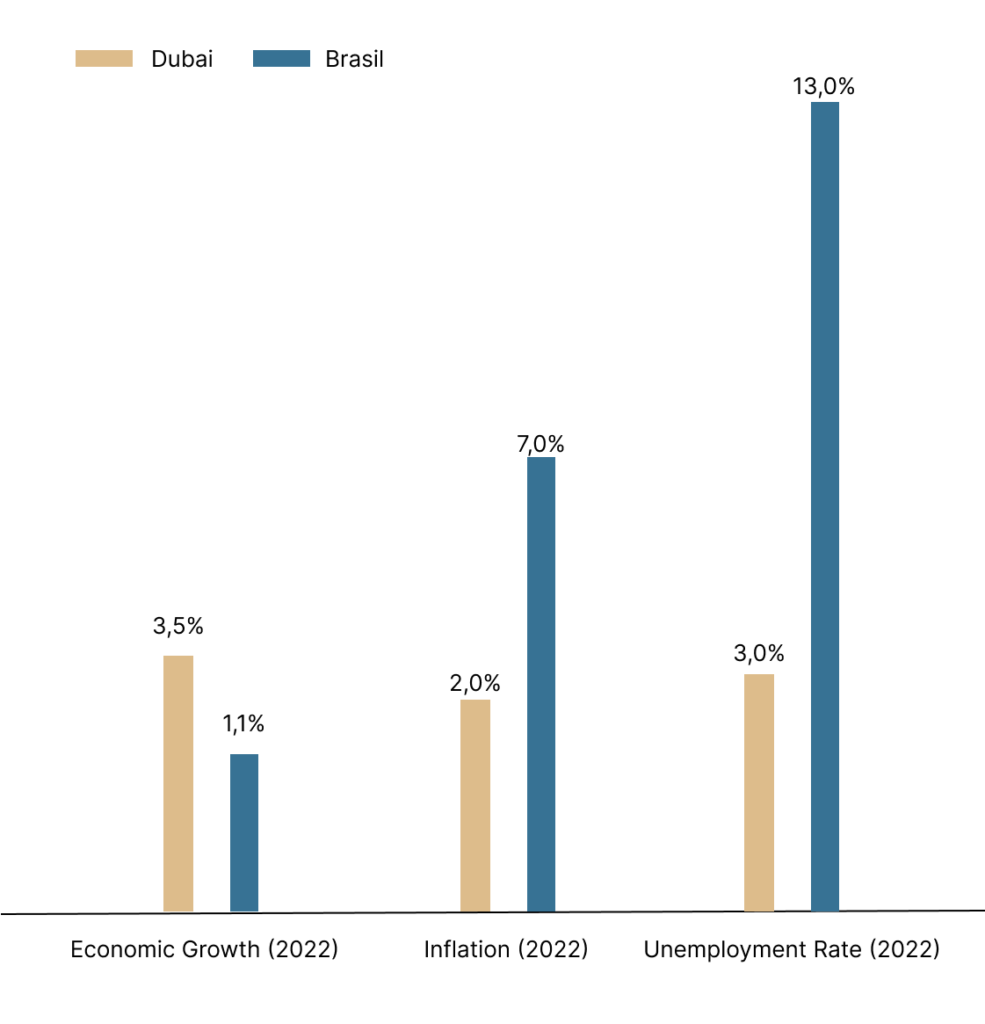

Comparing Dubai to the Brazilian Real Estate Market:

The table below illustrates the difference in economic stability between Dubai and Brazil:

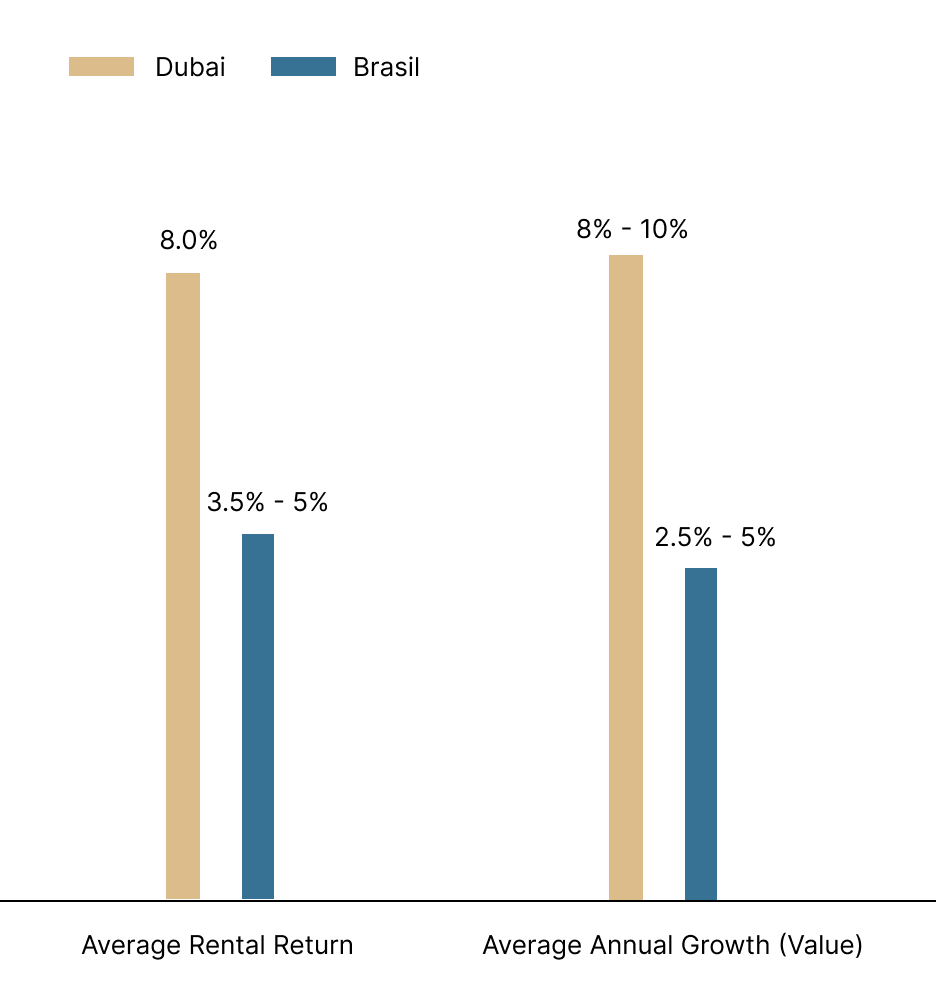

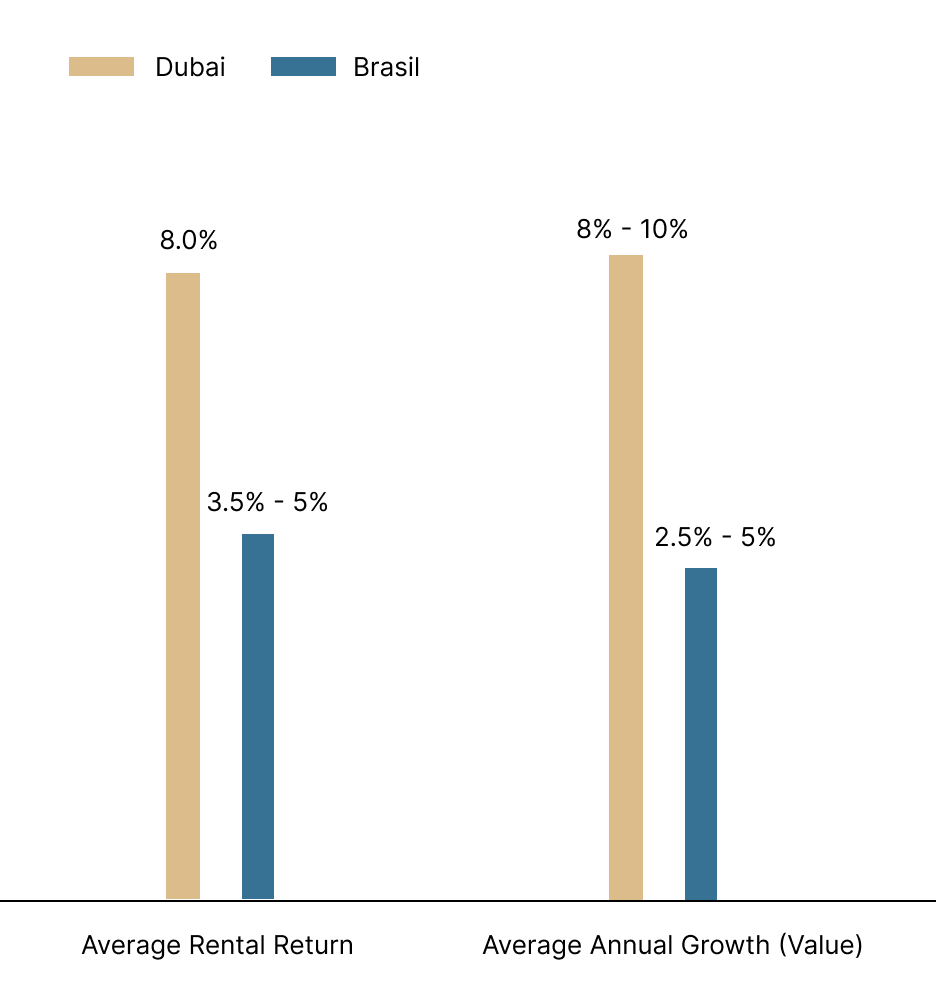

The chart below compares the average rental yield between Dubai and Brazil:

Ease of Doing Business:

The process of buying and selling real estate in Dubai is efficient and transparent. The entire process of purchasing an off-plan apartment can be completed within 2 business days.

Portfolio Diversification:

Portfolio diversification beyond Brazilian borders can reduce risk and increase potential gains, and Dubai serves as an excellent complement to your portfolio.

The Bright Future of Dubai Awaits You!

EXPO 2020

With Expo 2020 hosted in Dubai and ongoing investments in infrastructure, tourism, and technology, the city is poised to maintain its robust growth in the real estate market. Don’t miss the opportunity to be a part of this success!

Investing in Dubai is not just a smart choice, but also an opportunity to be a part of a city that constantly redefines global standards for luxury, innovation, and quality of life. Take advantage of the tax benefits, ongoing appreciation, and the friendly and diversified business environment that Dubai offers.

Get ready to embark on a journey to success in the real estate market of Dubai.

Your bright future starts here!

Unveiling the Robustness of the Banking System in the United Arab Emirates: A Haven of Stability

Are you an investor who values security and stability?

The United Arab Emirates (UAE) offers a remarkably robust banking system that rivals major banks in the United States and Europe. Let’s explore the reasons that make the UAE a reliable financial destination resilient to global turbulence.

Credit Ratings Comparison:

Emirates NBD and First Abu Dhabi Bank (FAB):

• Emirates NBD and FAB, the largest banks in the UAE, boast solid credit ratings.

• Moody’s has assigned Emirates NBD an A3 rating, while FAB received an even higher rating of Aa3. Standard & Poor’s (S&P) classifies both as A+.

• These credit ratings reflect the financial stability and capability of these banks to withstand global economic challenges.

Comparison with Banks in the United States and Europe:

• When compared to some of the largest banks in the United States and Europe, UAE banks often have similar or even higher credit ratings.

• This strength is a testament to the resilience of the UAE banking system, even when confronted with global economic shocks.

Resilience in Times of Global Crises:

Impact of Global Crises:

• Global financial crises, such as the Great Recession of 2008, had a significant impact on banking systems worldwide, including those in the United States and Europe.

• However, UAE banks displayed remarkable resilience during these crises, maintaining their solid credit ratings and avoiding significant collapses.

Why are the UAE more solid?

• The UAE has stringent financial regulations and effective oversight of the banking sector by the Central Bank of the UAE, contributing to stability.

• Additionally, sovereign wealth funds like the Abu Dhabi Investment Authority (ADIA) and the Dubai Investment Fund (DIF) play a crucial role in safeguarding and stabilizing the UAE’s financial system.

Choose the Financial Resilience of the United Arab Emirates:

Dubai: The Fiscal Gem for Global Investors

Taxes in Dubai: A Tax Haven

•

•

•

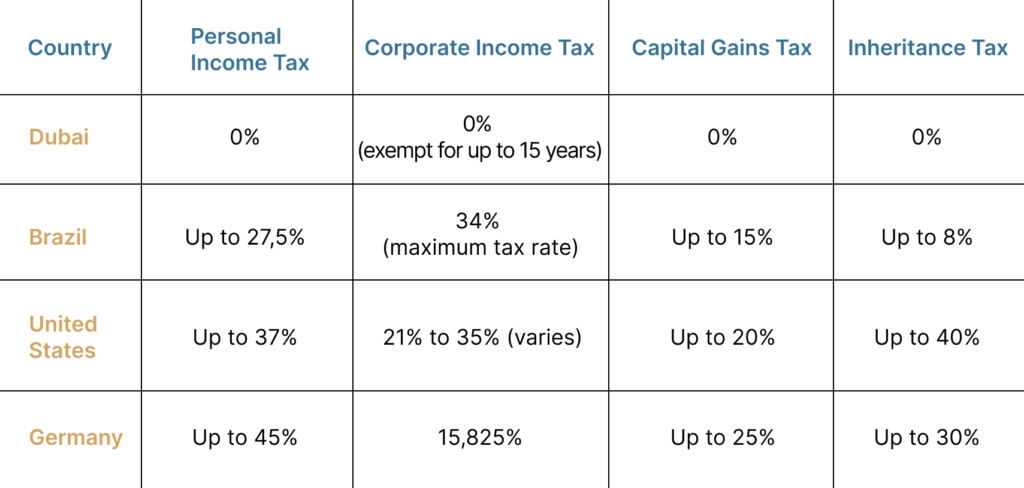

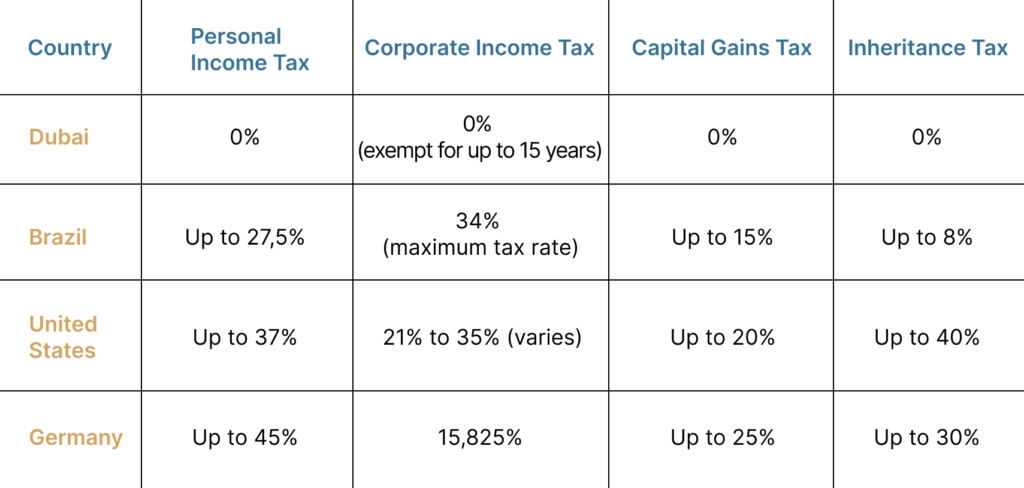

Tax Comparison in Dubai, Brazil, United States, and Germany:

Why Choose Dubai?

Investing in Dubai means retaining more of your money, seizing tax-free growth opportunities, and safeguarding your wealth for future generations. Be wise with your investments and choose Dubai as your destination to achieve financial success without the traditional tax burdens. Dubai is where your profits thrive, free from tax worries.